2025 Year in Review: Crypto Credit Markets

Explore our comprehensive analysis of the crypto credit landscape throughout 2025, including major developments and trends in both OTC and DeFi lending markets.

2025 Year in Review: Crypto Credit Markets

Explore our comprehensive analysis of the crypto credit landscape throughout 2025, including major developments and trends in both OTC and DeFi lending markets.

Written By: Alex Stan, VP Trading - Credit

Overview:

This report provides a comprehensive analysis of the dynamic crypto credit landscape throughout 2025, exploring major developments and trends in both OTC and DeFi lending markets. Drawing on insights from our institutional credit desk, it examines critical catalysts, emerging opportunities, and persistent challenges that defined the year, offering a forward-looking perspective on the evolving future of digital asset lending.

Key Insights from the Desk:

Bitcoin-backed lending continues to lead institutional credit markets, but 2025 has seen notable shifts: high demand met with compressed rates, tighter LTV ratios, and diminished product differentiation. Hedging demand has surged for select altcoins, including SOL, WLD, APT, ENA, TON, and EIGEN, as participants manage volatility and exposure. Treasury management solutions have gained traction for non-yielding tokens like BTC, XRP, ADA, and XLM, enabling counterparts to generate returns on idle holdings. Market volatility has driven strong interest in termed stablecoin yield structures to secure returns and reduce investment risk. Finally, CeDeFi credit models are rising as onchain and offchain markets converge. Generally, we are moving away from vanilla structures and into more bespoke white-glove solutions. We'll explore some of these trends, along with drivers, implications, and opportunities in greater depth below.

Crypto Rate Markets:

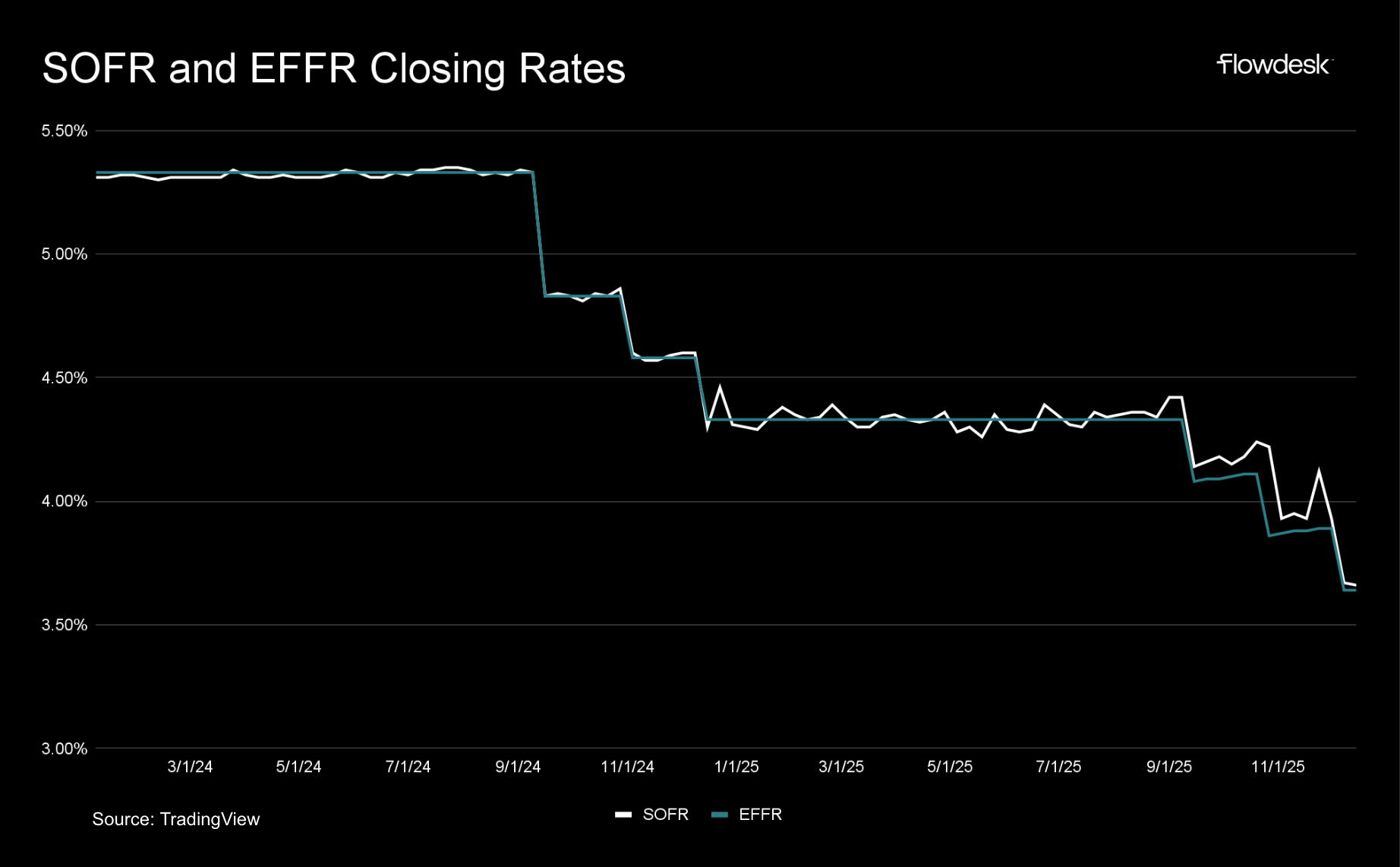

Before diving into the trends, let’s first examine the key metrics across CeFi and DeFi markets. Unlike in tradfi, there isn’t a market index rate for overnight capital, or a widely accepted benchmark such as SOFR. Therefore we need to factor multiple rate markets, specifically onchain money markets, perpetual funding rates, and exchange traded basis spreads. In 2025, compared to the prior year, we have seen a wide compression in rates across these markets.

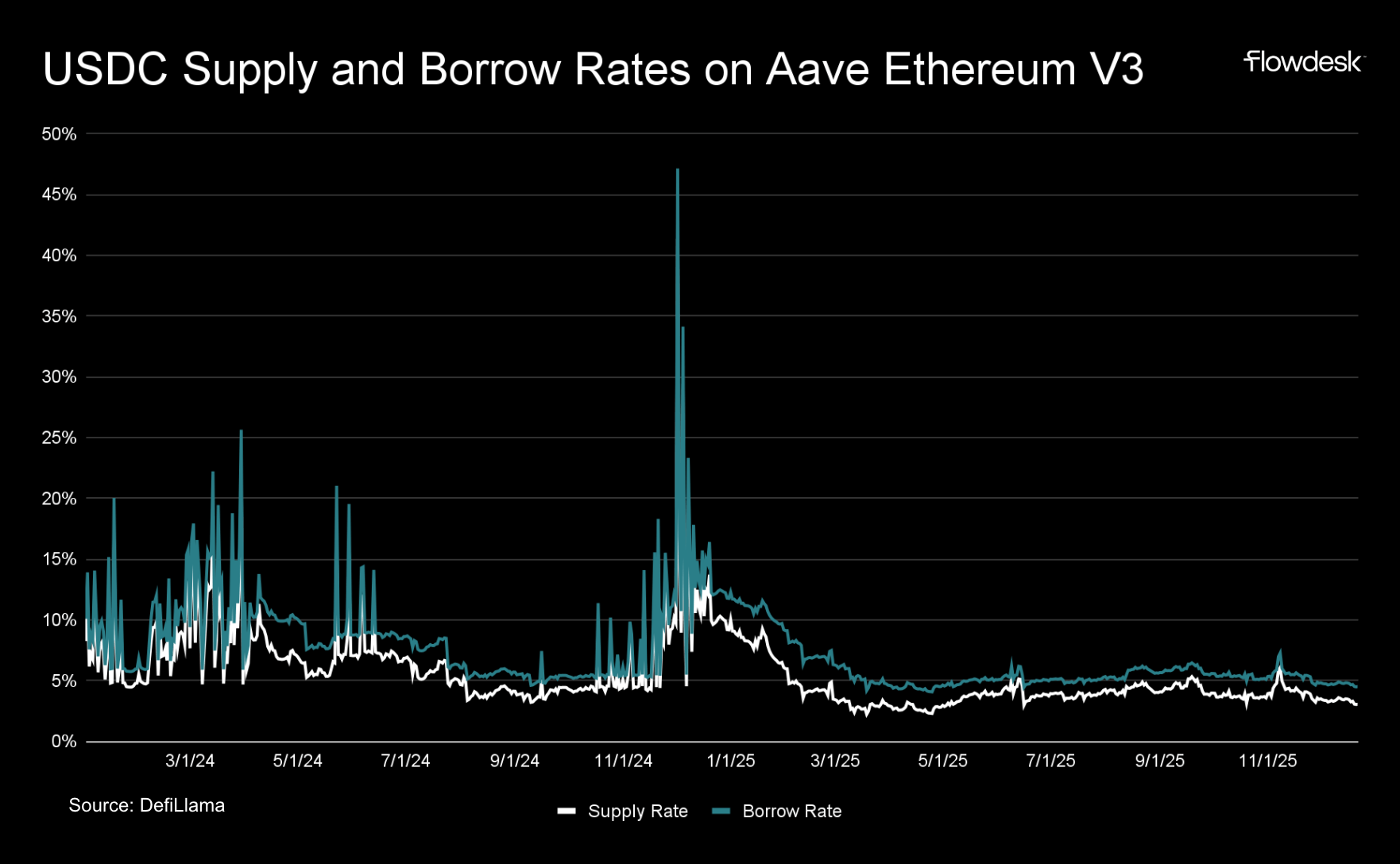

First, let's look at onchain markets, primarily focused on USDC on Aave Ethereum V3. Borrow rates for the majority of the year have hovered around the 5% mark averaging 5.87% through Dec 22nd 2025, a stark contrast to an average of 9.01% in 2024. In 2024, we saw borrow rates spike a handful of times, specifically during the run up to all time highs post the BTC ETF mania and following Trump's election, and although we hit all time highs multiple times between July and October of 2025, we did not see that same sort of volatility in onchain rates.

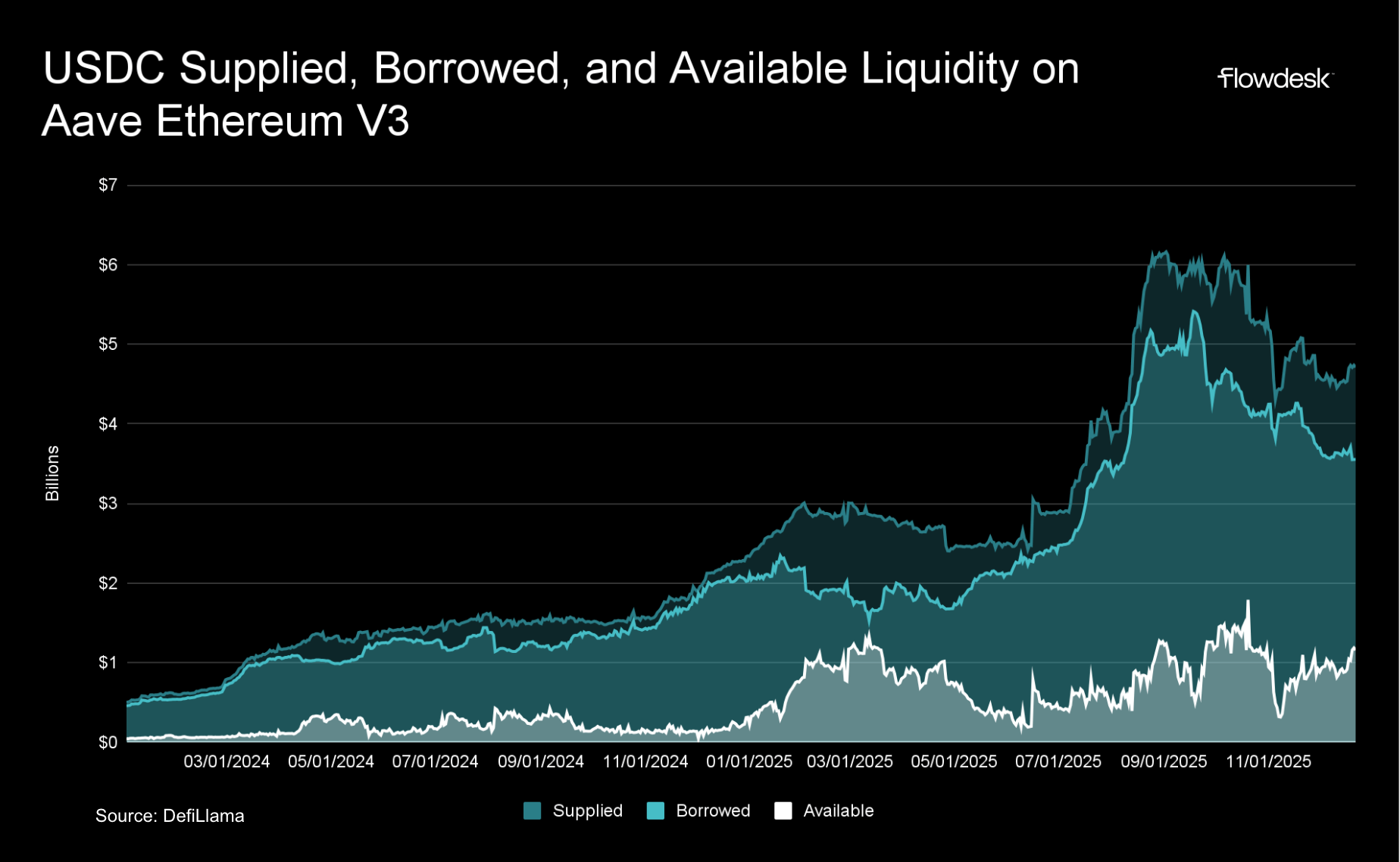

This compression might be seen as a lack of demand, but on the contrary, total USDC borrowed from this market hit all time highs in 2025, surpassing $5b, compared to just over $2b in 2024, and continues to stay elevated above the $3.5b mark. This demand has been met with an influx of supply, reaching over $6b in 2025, which has been keeping rates in line. This added liquidity is reducing volatility in onchain money markets even when demand is at all time highs, thus compressing rates.

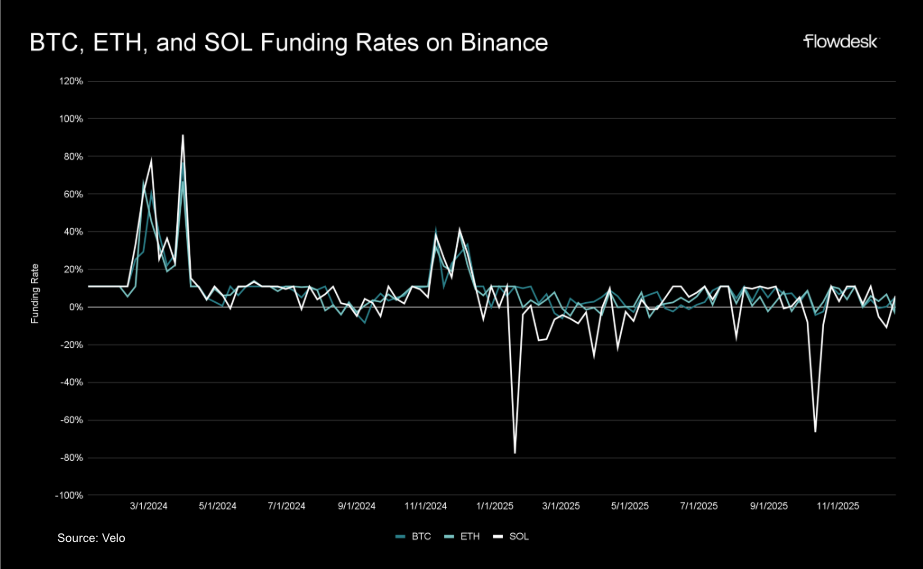

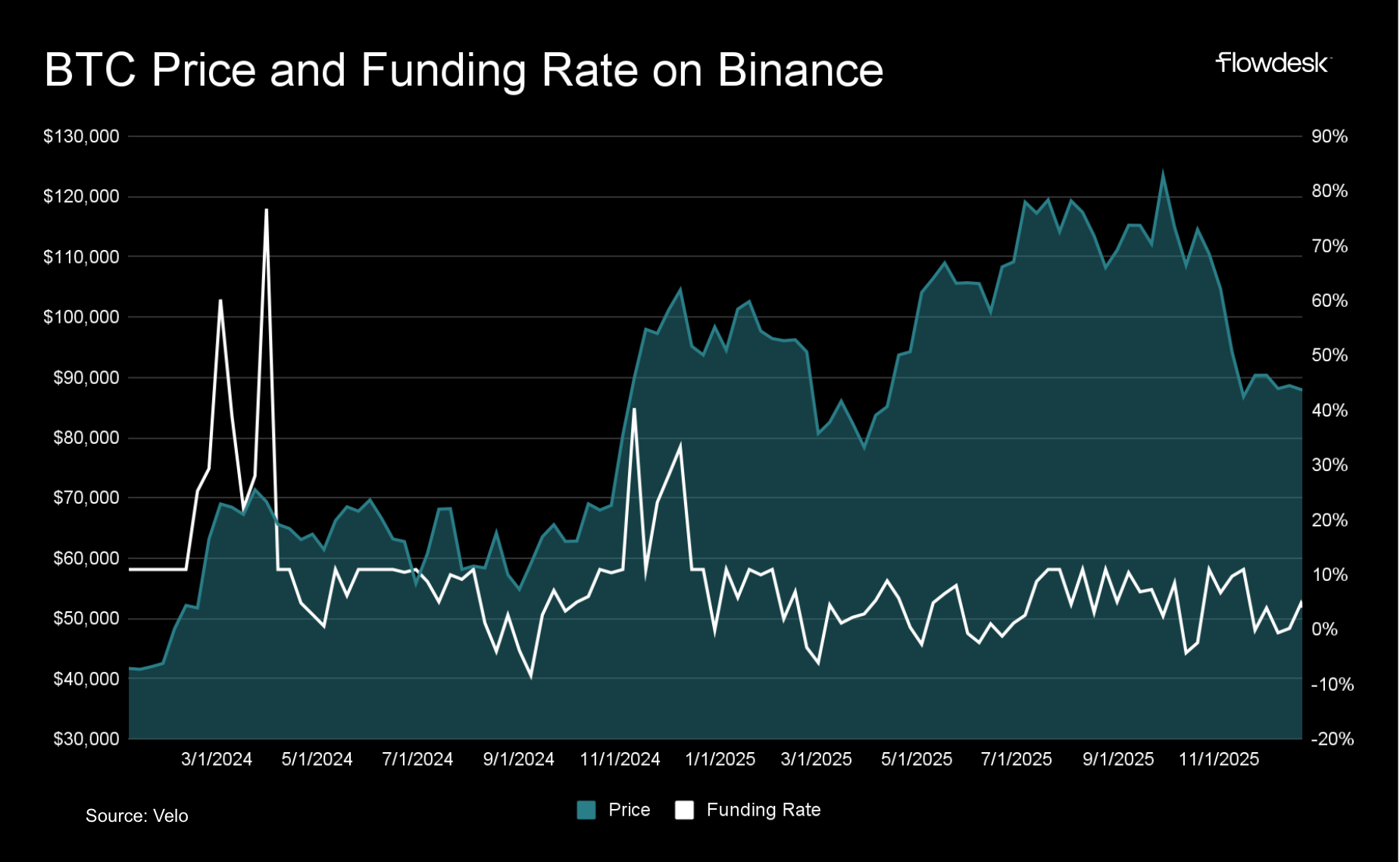

Next, let's look at perpetual funding rate markets. When funding rates are positive it means there is a demand for long leverage (cash/stables), and when they are negative there is demand for short leverage (coin). We can see a similar trend here on majors where funding rates did not break above 10.95% (equilibrium level) very often and even saw some deep negative wicks, specifically on SOL.

When focusing on BTC, although we made all time highs, we did not see the same spikes for long leverage demand as we saw in 2024, with funding rates rarely going above 10.95%, compared to 2024 when we would see wicks above 40% at times of market euphoria.

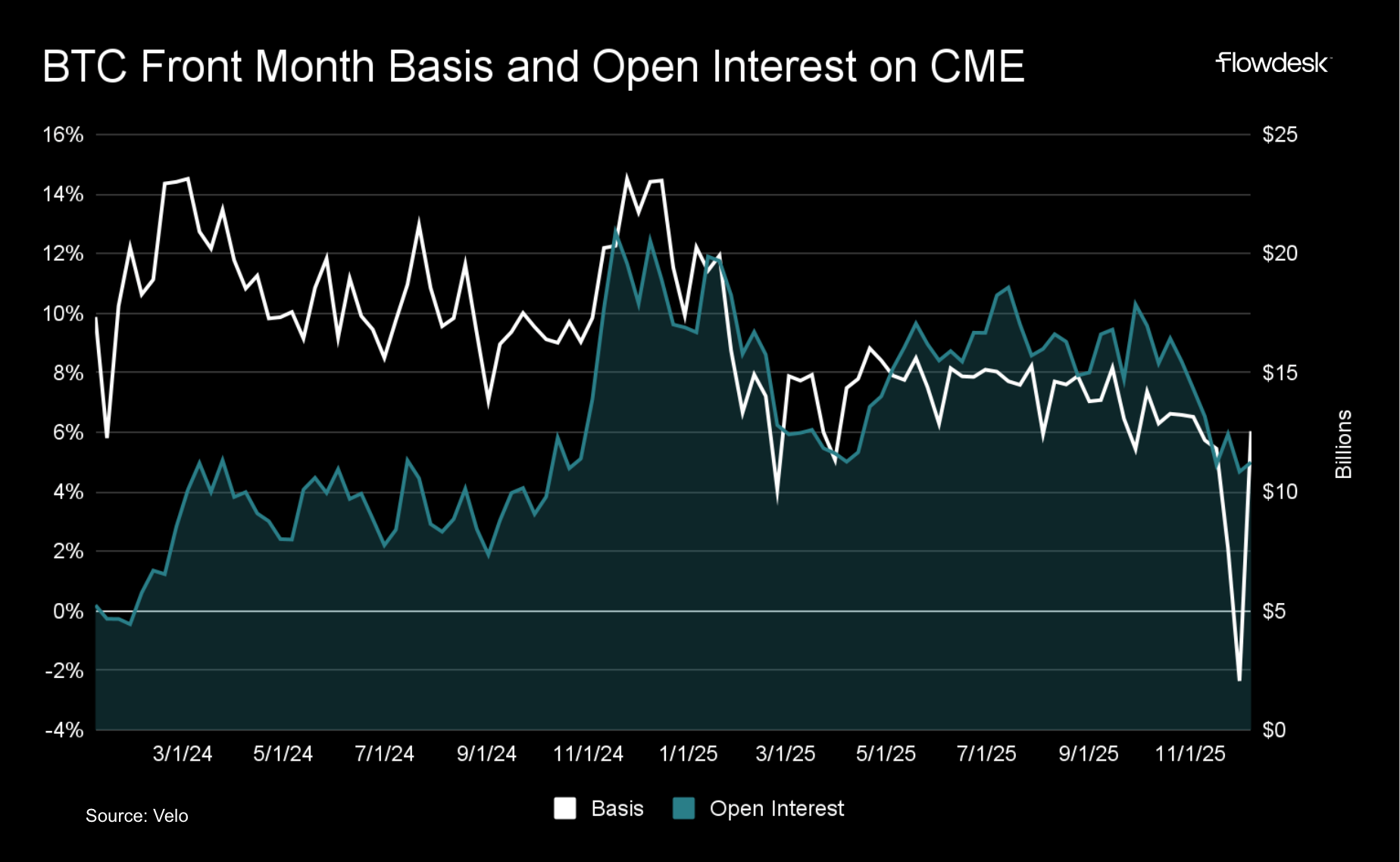

Finally, looking at exchange traded futures and the basis spreads, the story remains the same. Total open interest on Front Month BTC Futures contracts on the CME rose to near all time highs in 2025, but the annualized basis rate was effectively pinned below 9% and even wicked negative at the beginning of December for the first time since 2023, as a large unwind of basis positions took place. This compression could largely be attributed to less speculation on the CME futures contract itself and more delta neutral positioning to capture the basis spread.

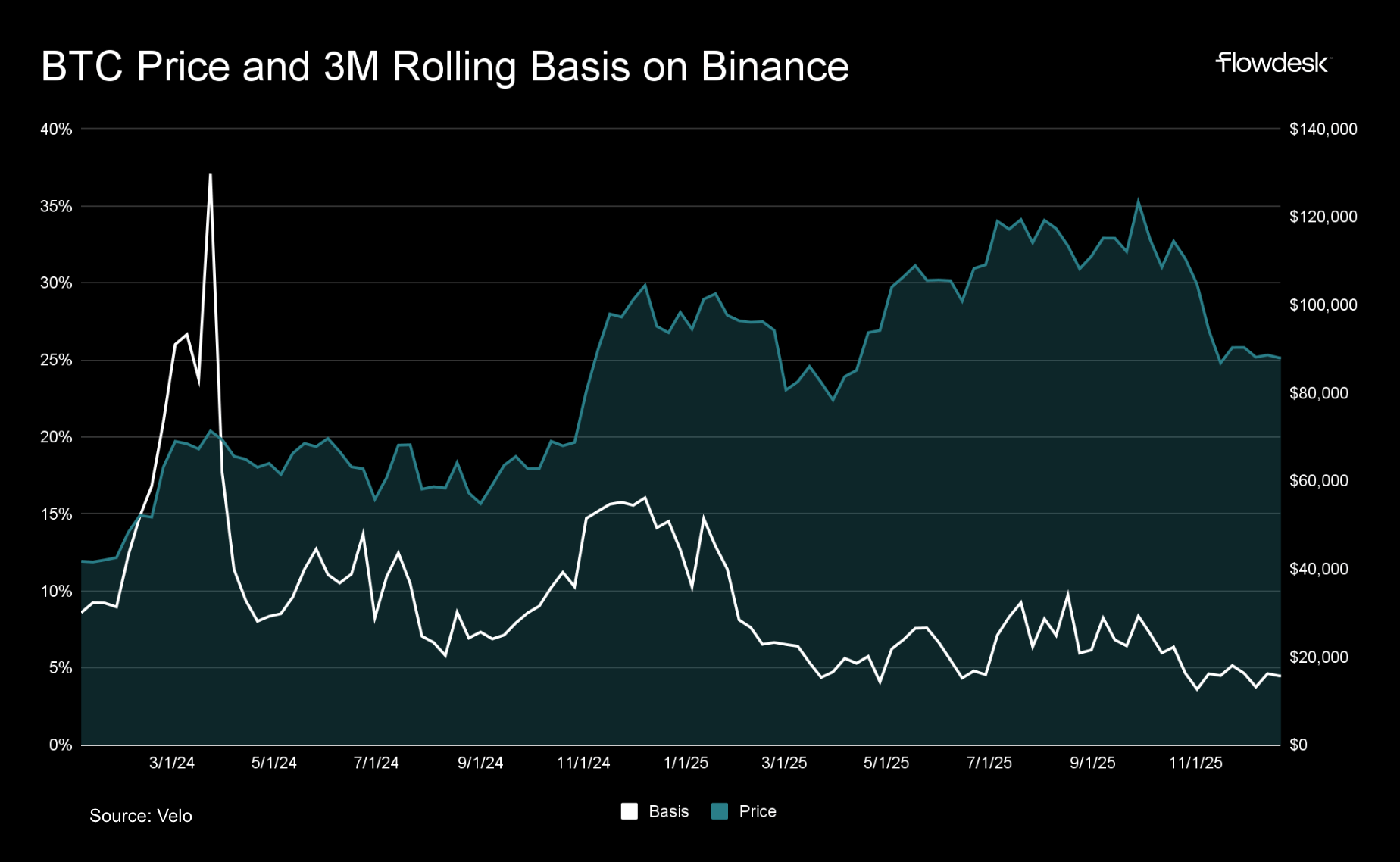

Similarly, when looking at the 3m rolling basis on Binance, we can see that although BTC price hit all time highs, basis continued to grind lower, dipping below the 5% mark.

Ultimately, as more participants and liquidity enter the market, it makes sense for these rates to go lower and volatility to decrease. It is beneficial for the industry to establish a more consistent and stable cost of capital, and as these arbs continue to get closed, it will only continue to normalize.

OTC Dynamics:

Naturally, OTC markets are more of a black box, but there are a few dynamics to pay attention to. Most principal credit desks, not agency desks, interact with these markets on a daily basis, and are typically used for pricing and assessing existing and new opportunities. The above markets are generally short dated and variable, as the rates fluctuate constantly in the case of onchain and funding markets. Movements in these markets influence the short dated end of the curve for OTC borrow and lend axes.

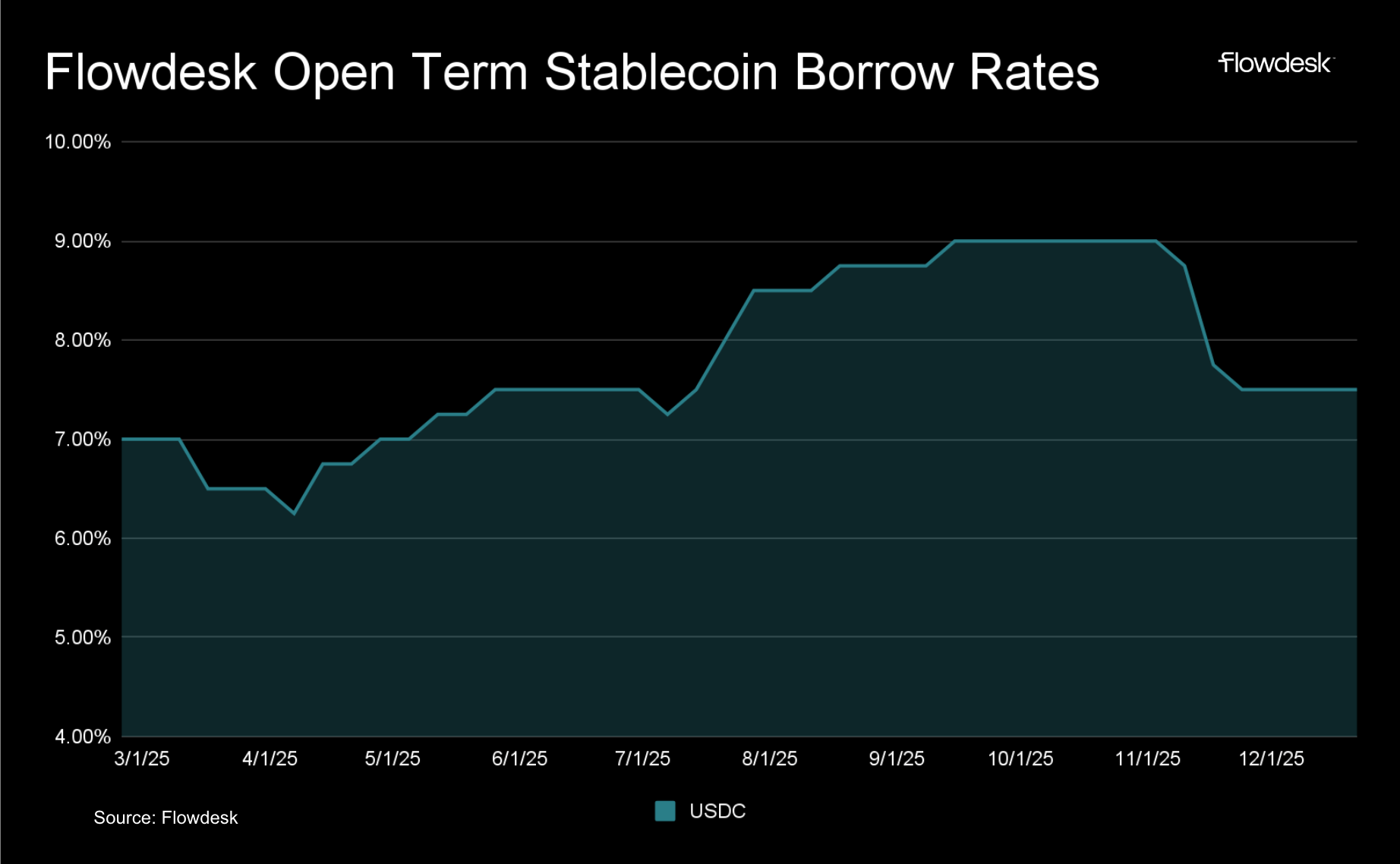

Similarly to the observable market, our bid for OT stables grinded higher throughout the year and plateaued in October before coming off to end the year. These movements are influenced by various factors such as our axes getting filled, but a large part is where the broader market is trading at.

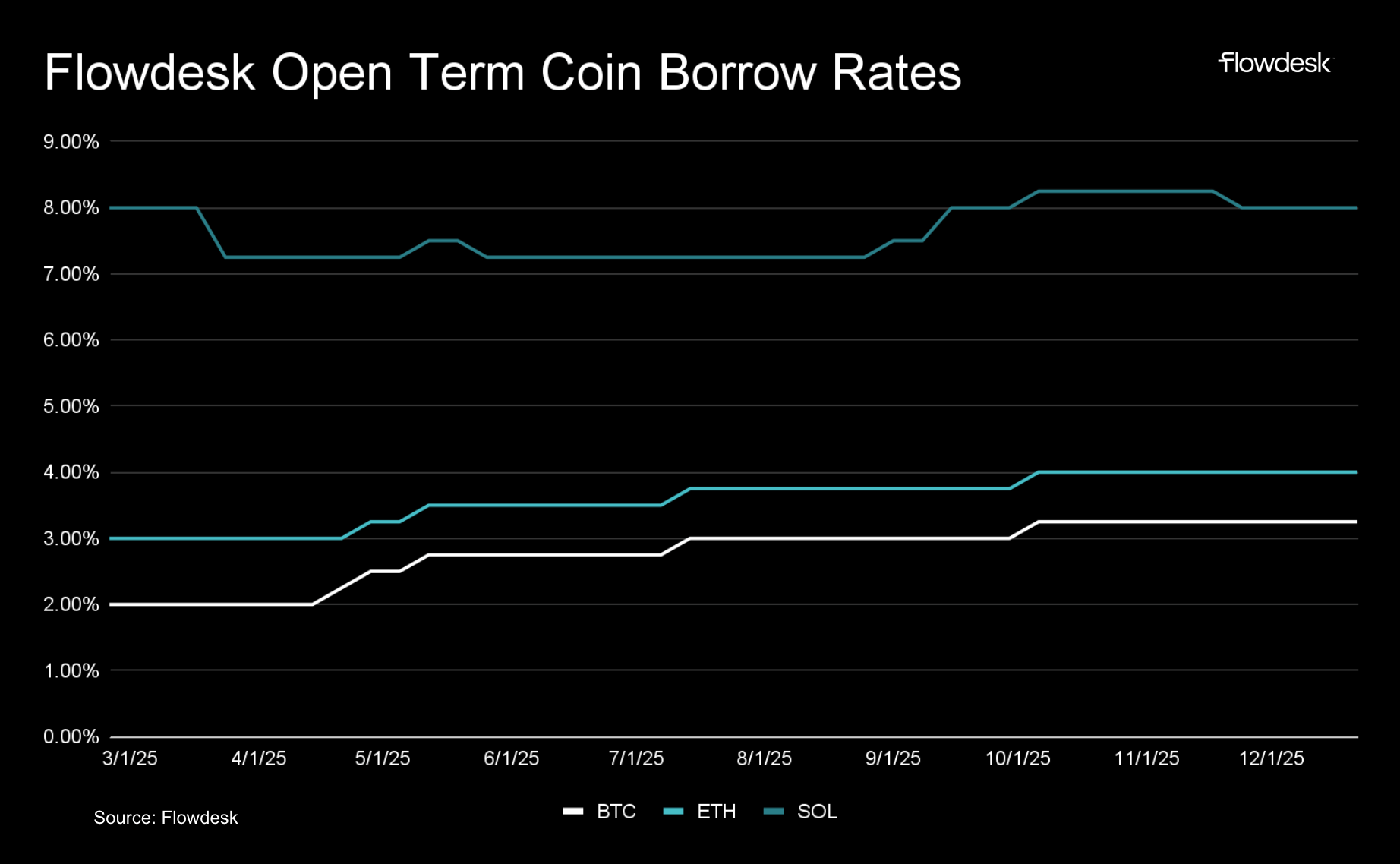

When looking at our OT borrow bid on majors, they don’t fluctuate as much and have even grinded consistently higher throughout the year. This is driven by a handful of factors, including the native yield, collateralization factors, and market rates of these assets. For example, SOL and ETH both have native staking rates, most investors will choose to stake these assets rather than lending them unless they earn a credit spread on top that makes it worthwhile. On the other hand, an asset that doesn't have a native yield like BTC but has a high collateral factor is attractive for investors as lenders and OTC desks as borrowers.

Generally, the short dated end of OTC curves are heavily influenced by the prevailing market rates, while the longer dated end of the curve is generally more influenced by each firm's view on where market rates are going and liquidity profiles.

Major Trends:

Some of the major trends that we saw persist throughout 2025 include the commoditization of BTC backed lending, locked token hedging, and treasury management services. These trends have largely shaped the composition of most credit books and will continue to be large drivers of demand.

Firstly, the commoditization of BTC backed lending has probably been the largest trend of the year. What used to be a bespoke offering has turned into a mainstay across both crypto native desks and tradfi desks. Given its liquidity profile, BTC has positioned itself as a pristine collateral asset for credit desks to underwrite. Although crypto native shops have been underwriting BTC for years, more and more tradfi players are entering the market, which is a large shift from just a couple years ago. The edge in BTC backed lending is disappearing, and as more liquidity enters the market, everyone is competing for the same deals, thus tightening margins and increasing LTVs. The juice on these trades that existed less than a year ago has sharply decreased, and has transformed into a high volume low margin offering offered by desks.

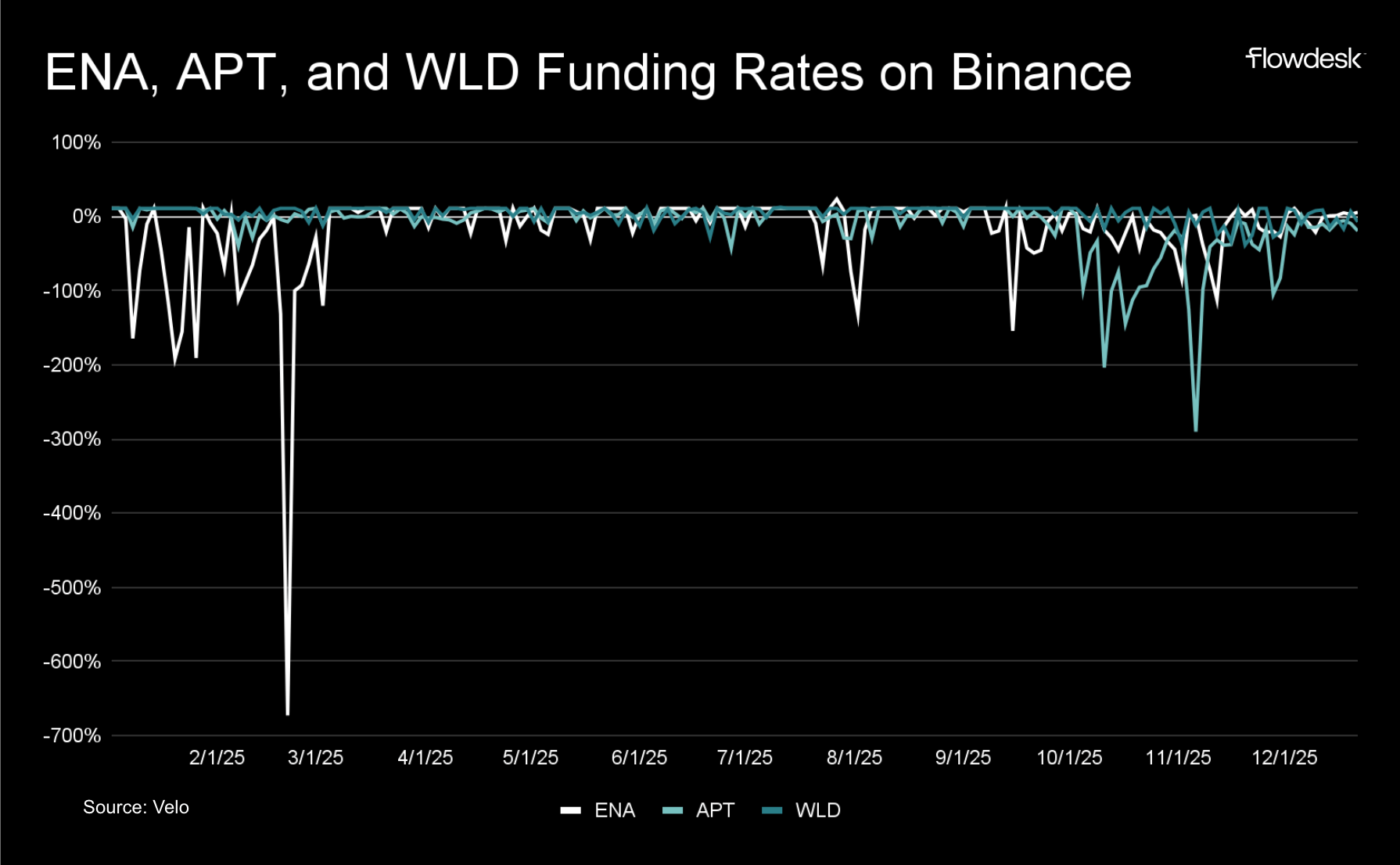

Secondly, locked token hedging has been a trend that we have seen persist for a couple years, but 2025 has been notable with outsized demand. VCs and early investors typically turn to OTC desks for hedging solutions on their locked allocations via derivatives transactions or short selling via credit transactions. There were several large unlocks throughout the year, including a large SOL unlock in April, that drove this demand. Some other notable names of interest we saw were ENA, APT, and WLD. A good metric for hedging demand on these assets are funding rates, as some investors turn to the perpetual futures markets for hedging exposure.

These funding rates flip negative as investors pile into short positions, and typically have extreme wicks to the downside as an unlock is approaching. Investors are exposed to a variable funding rate, which is effectively the cost to borrow that asset. Investors can turn to credit desks to get fixed rate financing rather than be exposed to variable rates that can spike to less than -100% at times.

Finally, treasury management solutions have been a large driver of demand throughout the year, particularly from foundations and funds that wish to monetize idle assets on their balance sheets. Whether that's tokens or stables, these counterparts can turn to credit desks for yield on their assets. This is particularly valuable for tokens that don't have any inherent yield such as BTC or XRP. These assets can be lent to credit desks for a fixed annualized yield paid in kind, providing funds or foundations a way to monetize their balance sheets and stack more of the assets they are holding.

Looking Forward:

Looking ahead, some of the key opportunities include the demand for bespoke credit offerings across all crypto assets, the convergence of onchain and offchain markets, and the development of more sophisticated onchain rate markets.

As mentioned, BTC backed lending has been commoditized across most desks. The edge in the years to come will be from desks that have the technical and market expertise to move further out on the risk curve and offer bespoke credit structures on a wider range of crypto assets, particularly alts. We have already seen this demand pick up and at the time of writing the total crypto market cap excluding BTC exceeds $1.2T, the assets that make up this number are generally underserved compared to BTC, at least in the world of credit markets. Flowdesk has been a pioneer in offering white glove credit services on a wide range of crypto assets and we are continually expanding our services in this regard.

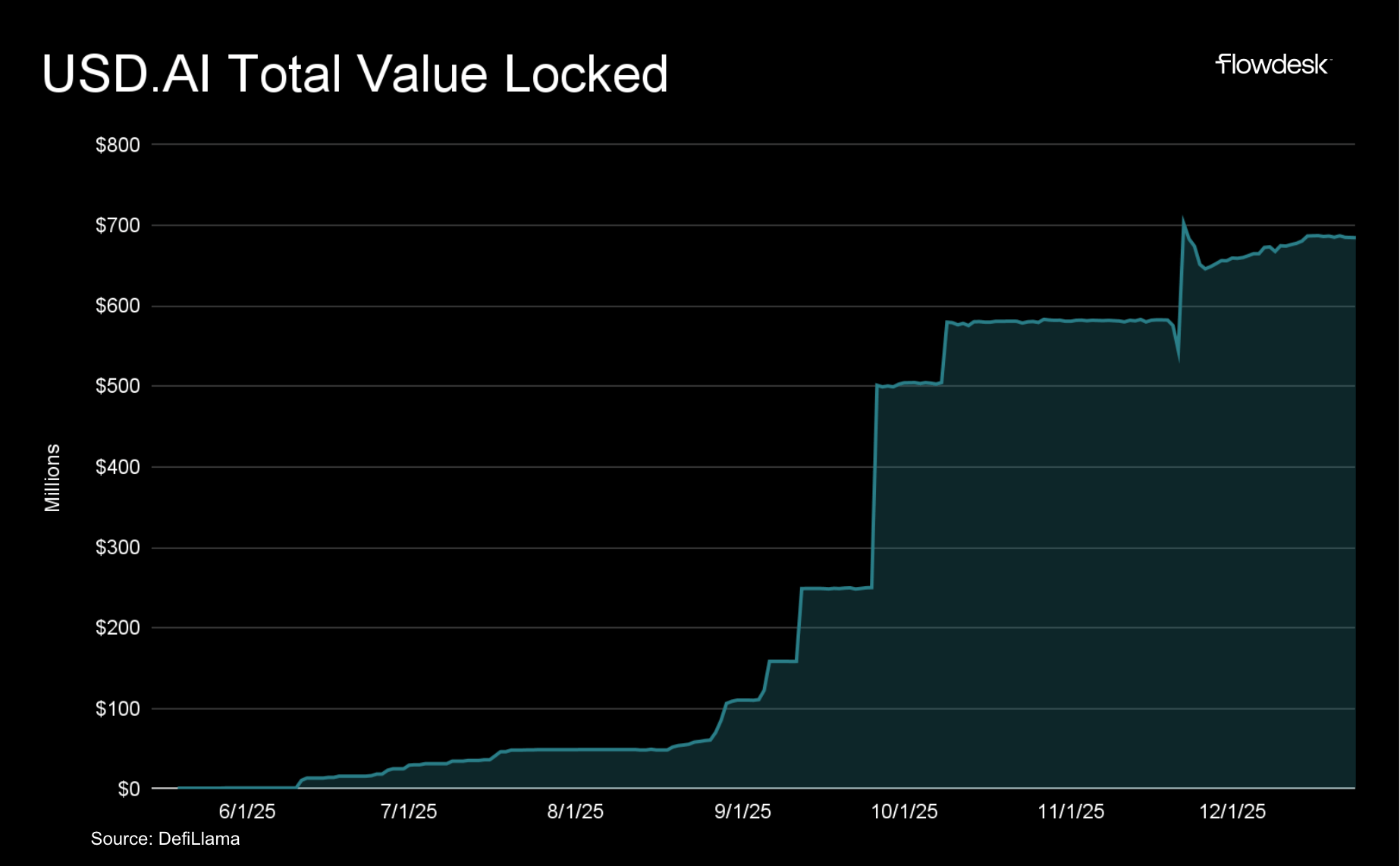

Next, we anticipate the convergence of onchain and offchain credit markets to accelerate. We have already seen some notable developments in the world of tokenization that will be the catalyst for this convergence. USD.AI is an example where onchain participants are able to get exposure to offchain private credit transactions backed by AI chips. Onchain users get a yield bearing token, backed by the offchain collateral, that can be used across DeFi or in other credit transactions as collateral to unlock liquidity, offering attractive yields and liquidity. TVL has already grown to nearly $700m and we believe more of these similar products will hit the market in 2026.

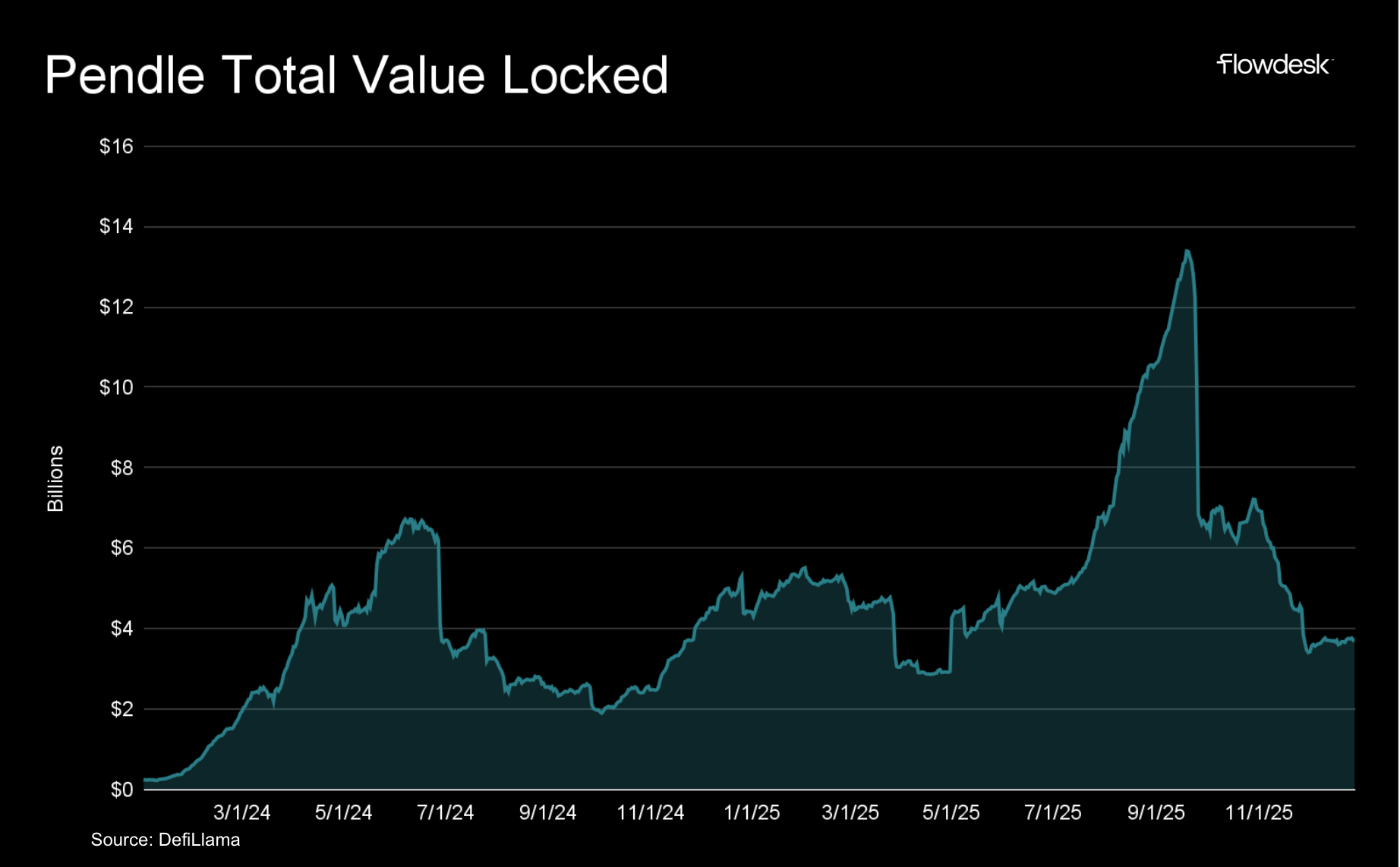

Finally, the expansion of rate markets across DeFi is a narrative that's worth keeping an eye on. Most onchain money markets are variable rates, meaning that you are exposed to market volatility without any good ways to hedge this exposure. With more sophisticated onchain rate markets, you will be able to hedge variable rate exposure, lock in fixed yields, and take a view on where rates will go in the future by going long or short yields. Pendle is an example of a protocol where users can trade variable for fixed yields. USDe and sUSDe have driven most of the demand thus far, but with expanded markets we expect this demand to carry over to other assets as desks and investors look to hedge interest rate exposure.

Conclusion:

In summary, 2025 was a cornerstone year for crypto credit markets. With new participants entering the markets and new developments onchain, we anticipate this growth to exponentially increase over the years to cover a wider range of assets. We are still in the early stages and crypto is an industry at the forefront of innovation, so it will be interesting to see where we are at this time next year.

Disclaimer

The report here is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Flowdesk Group or any third party service in any jurisdiction in which such solicitation or offer would be unlawful under the laws of such jurisdiction.

Further readings

Flowdesk Integrates Morpho to Support its Global Trading Business

Explore how Flowdesk utilizes Morpho in its day to day operations to access capital and optimize its balance sheet across its global trading verticals.

Flowdesk Secures $100 Million Credit Facility from Two Prime

The facility will support Flowdesk’s global expansion and trading infrastructure. Borrowings will be secured by bitcoin holdings.

Crypto Market Making: Retainer vs. Loan / Call Model

Explore the role of market makers in the crypto world and discover key models to ensure token liquidity and price stability. This guide helps token issuers evaluate strategies and ask the right questions to make informed market-making decisions.

Flowdesk Launches Institutional Credit Desk, Expanding Capital Solutions Offering

Flowdesk, a full-service digital asset trading and technology firm, today announced the launch of its institutional Credit Desk.

Market Update - April 17th, 2025

This week in crypto was notably quieter than last as markets continue to digest tariff and macro updates. Liquidity conditions in the order books improved across exchanges, and without major headline catalysts, activity levels returned to a more measured, tactical rhythm.

Flowdesk finalizes $102m equity financing round with extension from HV Capital and debt from BlackRock-managed funds to accelerate global expansion

Flowdesk, a full-service digital asset trading and technology firm, today announced the close of its $102m financing round, including further equity support from existing shareholders and HV Capital as well as debt from funds and accounts managed by BlackRock.